Features

Management

The 2023 RAS progress report

How far away is land-based salmon aquaculture from proof-of-concept?

December 29, 2023 By Matt Craze, Spheric Research

A RAS tank at Salmon Evolution Indre Harøy facility in Norway.

Photo: Salmon Evolution

A RAS tank at Salmon Evolution Indre Harøy facility in Norway.

Photo: Salmon Evolution Four-kilo Atlantic salmon swim in perfect harmony at the huge tanks at Salmon Evolution’s Indre Harøy site in Norway in mid-August. They were due to be harvested the following week.

This is now Salmon Evolution’s third batch of fish since opening its modern hybrid flowthrough facility in 2022, and things are going well, despite a minor mortality event in May. The company is on track to grow a record biomass of 1,620 tons in Q3, and steady-state production of the plant’s 7,900 tons a year of installed capacity is expected by the end of the year.

“We thought that we had proven concept on the first batch, but proof of concept is doing it time and time again,” said the company’s finance manager, Hans Petter Mortveit. “Maybe we can say at the end of the year that we have achieved proof of concept.”

Proof of concept

Proof of concept doesn’t necessarily translate into good news for full-blown salmon RAS. Salmon Evolution replenishes a third of its water needs, and with the constant of fjord water replenishing its tanks, it can live without a biofilter, relying only on drum filters for particle removal.

Atlantic Sapphire, which has long held the flag for a full recirculation system, is at the lowest point in its history after reporting further setbacks related to temperature, leading to a collapse in the company’s share price. The company is installing new chilling equipment in September, which it says will solve the problem. But industry observers are not convinced.

“The hope of a full capacity harvest by the end of this year has faded,” said Mindaugas Cekanavicius, an equity analyst at Norne Securities in Norway, who rates Atlantic Sapphire’s stock a “hold”. “No more harvest targets are provided, while the Phase 2 construction is basically paused until break-even results.”

Other front runners

With Atlantic Sapphire still far from proving concept in Miami, it will be upon others to reach steady state. In Spheric Research’s second edition of its Land-based Aquaculture Report, published in 2021 via Undercurrent News, we identified a new cohort of projects that could share the burden of being industry pioneers.

We identified 20 salmon full RAS projects that had positive traction in the third edition of our report, published in early 2022, and another nine developing hybrid flowthrough systems. None of those full RAS projects are as close as Salmon Evolution in demonstrating a consistent production pattern.

Two projects that have been funded via the Norwegian stock exchange – Nordic Aqua Partners in China and Proximar Seafood in Japan – both have fish in the water and are aiming to harvest in early 2024. Both companies have reported proficient project execution so far.

Knut Nesse, CEO of the AKVA Group and the engineering firm behind Nordic Aqua Partners, predicted at this year’s North Atlantic Seafood Forum that the China project will prove salmon RAS aquaculture at scale.

There are other industry front runners worthy of close attention. Danish Salmon, now owned by Japan’s Marubeni and Nissui Corp., was among the first companies to break the 1,000-ton-a-year production barrier. Arne Baekgaard, who oversaw the early success of the project, has now delivered a first harvest at Skagen Aquaculture, a brand-new facility also in Denmark. The company has an installed

capacity of 3,800 tons a year, which is similar in size to the Nordic Aqua Partners project.

In Sweden, Matthias Kamprad, heir to the Ikea fortune, has backed Re:Ocean, one of a few projects going ahead in the world. Hima Seafood is building a 7,000-tons-a-year trout RAS facility in Norway, following a surprising US$40 million investment from impact investment funds. Japan’s Maruha Nichiro, the world’s largest seafood company, teamed up with Mitsubishi Corp to build a project.

Beyond these exceptions, there are a handful of smaller companies that are reporting good progress. Patagonia King Salmon in Chile is harvesting chinook salmon in a RAS system, a first for that species.

Mainstream investors are still on the fence. Inflation in construction materials, leading to major increases in CapEx estimates, has not helped. Regulatory issues, meanwhile, have dogged the go ahead of projects in the U.S.

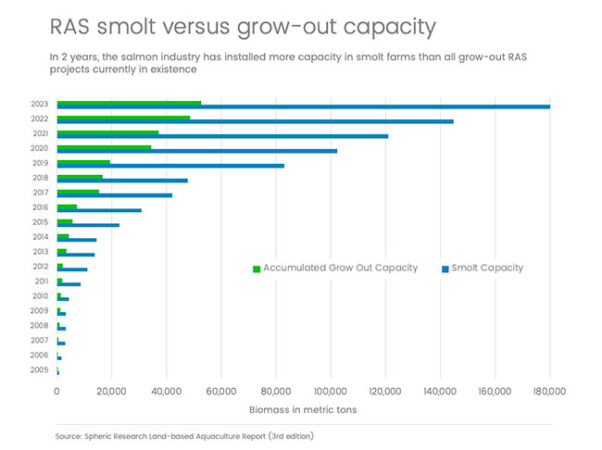

(Graph: Spheric Research)

Flowthrough success

With the strong performance of Salmon Evolution, and early success shown by Andfjord Salmon in ramping up another project in northern Norway, flowthrough systems are getting better access to finance when compared with full RAS projects.

Also in Norway, Gigante Salmon is moving ahead with a similar project, and Salfjord Salmon finally won a permit to build a project in the Scandinavian country. Critically, the land-based projects will not be subject to Norway’s resource tax on open net pen farming, which came into effect this year.

However, tax authorities are not issuing any new licenses to land-based projects until they have assessed the nature of hybrid farming. Some projects, where the flowthrough component of the project is caused by tidal water, might fall into a grey area, according to Anne Hvistendahl, the global head of seafood for DNB Bank in Norway.

Iceland has also become a hot spot for flowthrough projects, and most of these plan to tap underground water resources available on the volcanic Reykjanes peninsula. What makes Iceland unique is the availability of freshwater and brackish water at suitable temperatures, and the fact that Samherji, a major fishing company, has been successfully harvesting fish from land-based flowthrough farms for more than two decades.

First Water, a project previously known as Landeldi, announced June 30 that it raised €82 million (US$88.1 million) to fund the first phase of construction of its farm with capacity of 8,500 tons a year. Samherji also announced in August that it got regulatory go-ahead for its 40,000-tons-a-year megafarm.

Predictions

Transplanting the flowthrough concept to other countries may be difficult, given it involves discharge of fecal matter. The development of these types of projects may just be limited in scope to countries like Iceland and Norway, which have a strong fishing industry heritage and have been highly supportive of their aquaculture industries.

A RAS tank at Salmon Evolution Indre Harøy facility in Norway.

Photo: Salmon Evolution

Rabobank predicts that salmon production from flowthrough farms may exceed 100,000 tons a year by 2030, led by the current generation of projects in Iceland and Norway. The bank’s main aquaculture analyst, Gorjan Nikolik told Undercurrent News.

“You really see that there’s capital available for these projects,” he said. “They’re already demonstrating that there is going to be pretty good variable costs.”

While full RAS projects have an uncomfortable wait to proving concept, they may be helped by the emergence of the hybrid flowthrough sector. The building of new flow-through facilities is cultivating best practices in construction work, choice of building materials, and water treatment systems, all of which are applicable to full-scale RAS plants.

Just in the past year, dozens of industrial companies from providers of engineering solutions to oil and gas rigs to chemical companies, are introducing a new generation of products and services that can improve RAS.

Take companies like VEGA Grieshaber, which provides sensors to oil wells and mining companies. Or Denmark’s Desmi, which makes pumps for oil and gas. Or Evoqua Water Technologies, a water company that is introducing filtration equipment to RAS.

Post-smolt wave

The other tailwind that will serve the RAS industry is the rapid development of Norway’s post smolt industry. Just in 2023, Norwegian net pen farmers and dedicated smolt producers will commission more than 35,000 tons a year of smolt capacity, more than all installed capacity in the grow out sector to date, according to Spheric Research data. The standardization of RAS systems at the juvenile stage of mainstream farming can only help the industry in consolidating knowledge about indoor farming.

Companies like AKVA Group, for example, are honing digital systems on post smolt systems, and enabling more predictability without systems.

“The technology is not going as fast as we think,” AKVA Group’s sales director for land-based, Jacob Bregnballe, said at the recent AquaNor industry event in Norway. “There is a lot of information around that we can gather and become better in the future.”

Even with these tailwinds, it’s ultimately now beholden on the new cohort of projects, from Hima Seafood to Nordic Aqua Partners and Proximar Seafood, to demonstrate early success from first harvests. With limited supply, and the resounding popularity of salmon as a healthy, Omega-3 rich protein around the world, the type of proof-of-concept shown at Salmon Evolution will be a game changer for the industry that is short of product.

As founder of Spheric Research, Matt Craze has carried out consultancy projects in Latin America, Europe, and Asia. The company has carried out eight multi-client studies through an exclusive partnership with Undercurrent News. Through Spheric Research, Craze conducts business with several major agricultural and aquaculture companies, governments, and NGOs.

As founder of Spheric Research, Matt Craze has carried out consultancy projects in Latin America, Europe, and Asia. The company has carried out eight multi-client studies through an exclusive partnership with Undercurrent News. Through Spheric Research, Craze conducts business with several major agricultural and aquaculture companies, governments, and NGOs.

Print this page